-

Who We Are

Who We Are

Ajeenkya DY Patil University (ADYPU), known for its strong emphasis on innovation, is a renowned hub for young learners with entrepreneurial aspirations. We provide an ideal environment for young learners and aspiring entrepreneurs to develop skills for the ever-evolving world and nurture the growth of your startup ventures!

ADYPU

-

Academics

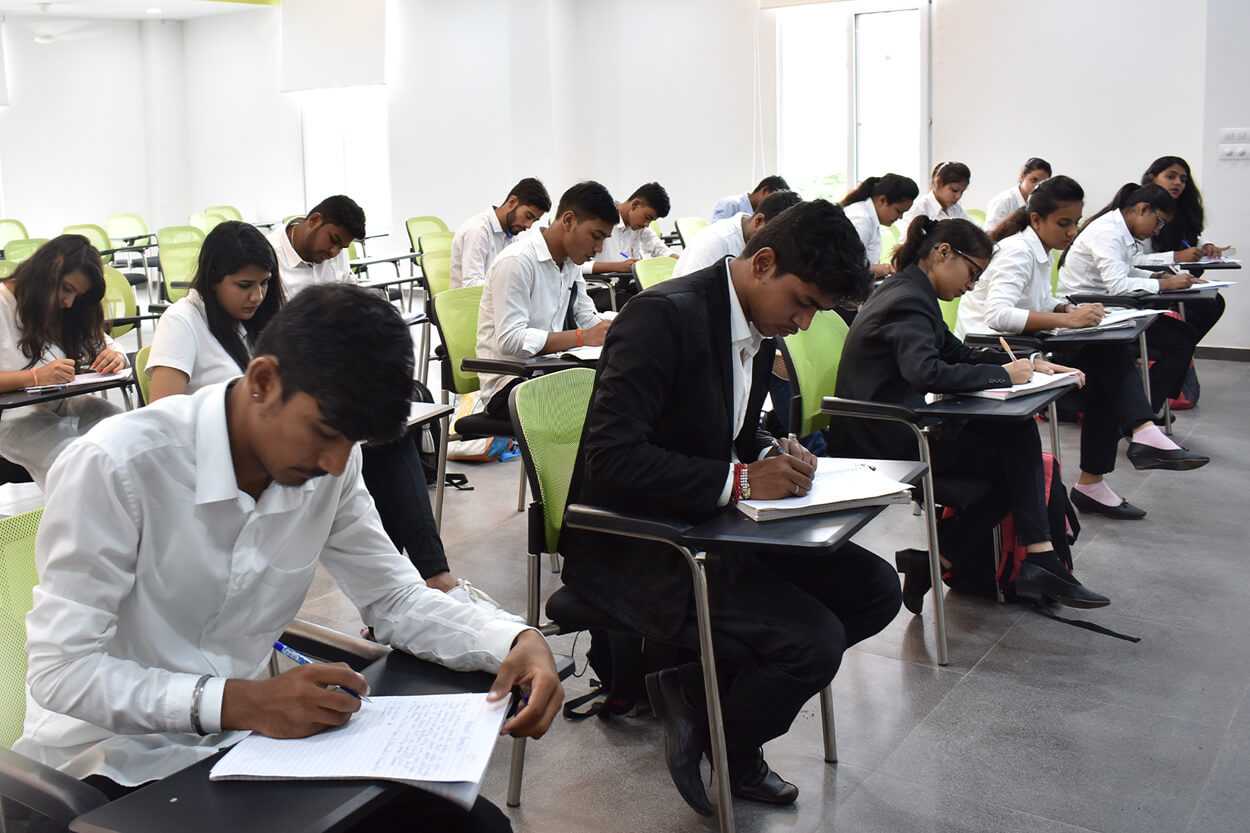

Academics

Ajeenkya D Y Patil University offers a vast array of unique and innovative academic programs tailored to equip students for success in their chosen fields.

-

Center & Initiatives

Center & Initatives

Ajeenkya DY Patil University has collaborated and taken out innovative initiatives in enhancing the overall education experience, giving students amazing hands-on experiences and connections with industry leaders thus and making a positive impact on society.

Entrepreneurship and Innovation Centre

-

Life at ADYPU

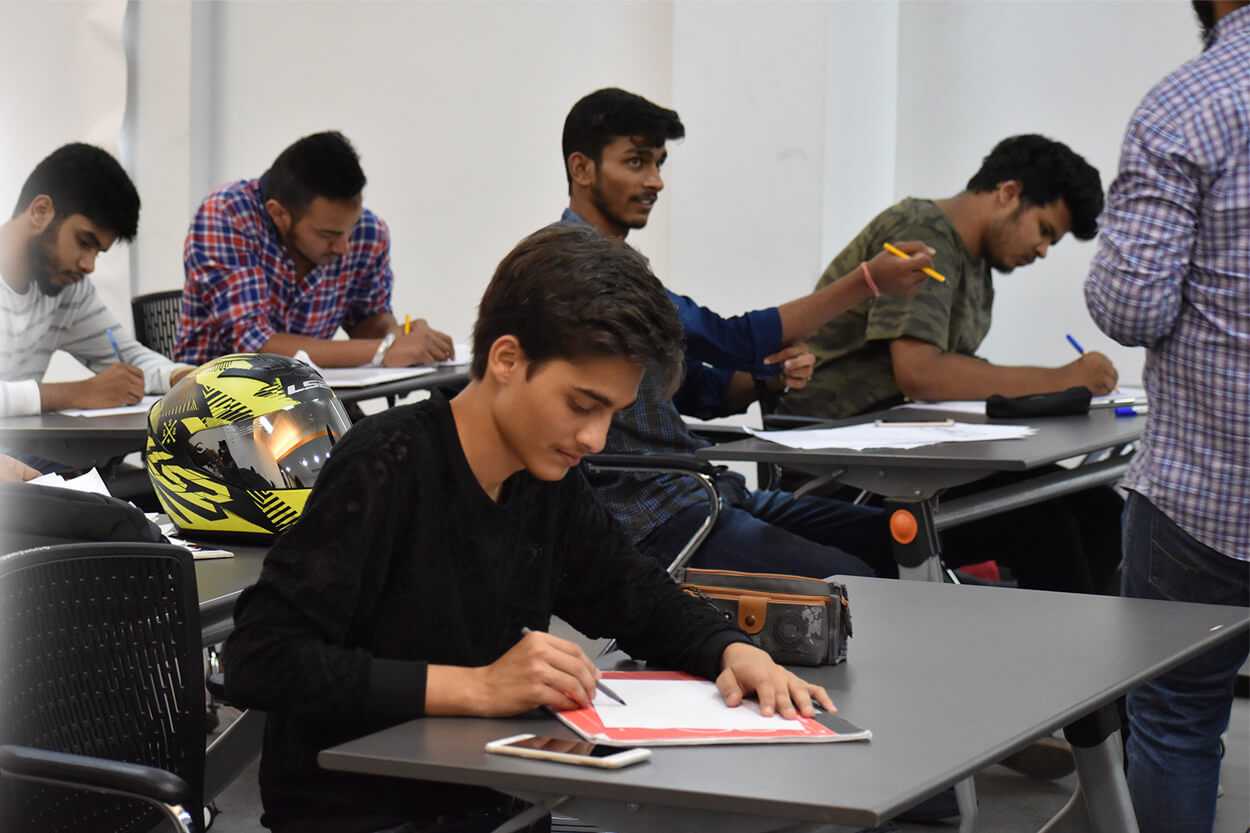

Life at ADYPU

Ajeenkya DY Patil University offers a rich and lively experience with student clubs, recreational activities and dynamic events to nurturing personal growth, leadership development and lifelong friendships.